Your Credit Is Not a Life Sentence — It’s Just the Starting Line

You’ve been denied loans. Ignored by lenders. Held back by a report that doesn’t tell your real story.

Your Credit Is Not a Life Sentence — It’s Just the Starting Line

You’ve been denied loans. Ignored by lenders. Held back by a report that doesn’t tell your real story.

Remove Negative Remarks

Increase Your Score

Maximize Your Credit File

Get Approved for Funding

Restore Your Confidence

What’s Standing in Your Way?

Credit Consultations

Schedule a personalized consultation to explore your best next steps.

Credit Analysis

We provide a comprehensive analysis of your current credit situation.

Credit File Clean Up

You’ll receive a full breakdown of your credit report and key impact areas.

What’s Standing in Your Way?

Credit Consultations

Schedule a personalized consultation to explore your best next steps.

Credit Analysis

We provide a comprehensive analysis of your current credit situation.

Credit Analysis

You’ll receive a full breakdown of your credit report and key impact areas.

We help eliminate...

Bankruptcy

Charge Off Accounts

Collection Accounts

Evictions

Inquiries

Late Payments

Medical Bills

Public Records

Repossessions

Student Loans

Get Out of Chexsystems and Early Warning

Get Out of Chexsystems and Early Warning

FINANCIAL EDUCATION

You gain access to expert resources designed to help you build a legacy and stay financially empowered for life.

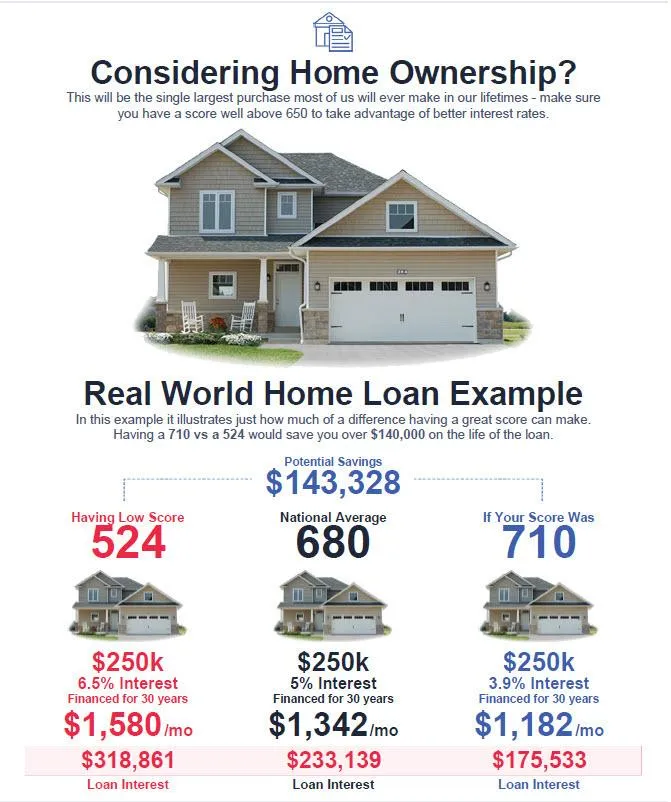

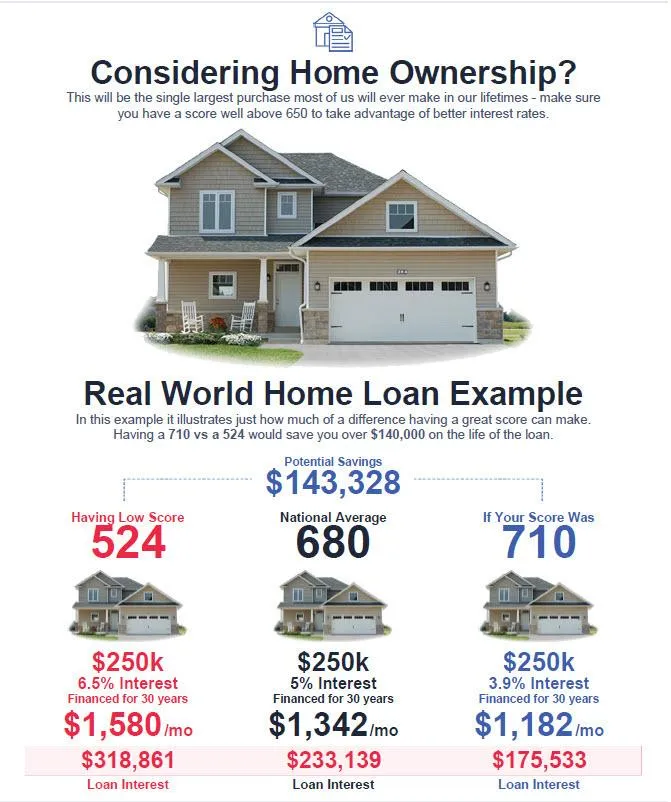

Build and protect a strong credit

Your credit is more than a score—it's your financial reputation. We help you establish a solid credit foundation and defend it with proven strategies, so you can move forward with confidence and unlock real opportunities.

Access to strategic capital

Getting the right funding shouldn’t be guesswork. We connect you to tailored capital and lending options designed to meet your goals, fuel your growth, and position you for long-term success.

Laying the Wealth foundation

We believe true wealth is built with intention. That’s why we guide you in creating a clear financial path—one that supports your present needs while building a legacy of prosperity for the future.

Are you looking to start a business?

Launch your business with confidence—structured for funding from day one.

FINANCIAL EDUCATION

You gain access to expert resources designed to help you build a legacy and stay financially empowered for life.

Build and protect a strong credit

Your credit is more than a score—it's your financial reputation. We help you establish a solid credit foundation and defend it with proven strategies, so you can move forward with confidence and unlock real opportunities.

Access to strategic capital

Getting the right funding shouldn’t be guesswork. We connect you to tailored capital and lending options designed to meet your goals, fuel your growth, and position you for long-term success.

Laying the Wealth foundation

We believe true wealth is built with intention. That’s why we guide you in creating a clear financial path—one that supports your present needs while building a legacy of prosperity for the future.

Are you looking to start a business?

Launch your business with confidence—structured for funding from day one.

COPYRIGHT. LILAC ADVISORY GROUP, LLC. ALL RIGHTS RESERVED

COPYRIGHT. LILAC ADVISORY GROUP, LLC. ALL RIGHTS RESERVED